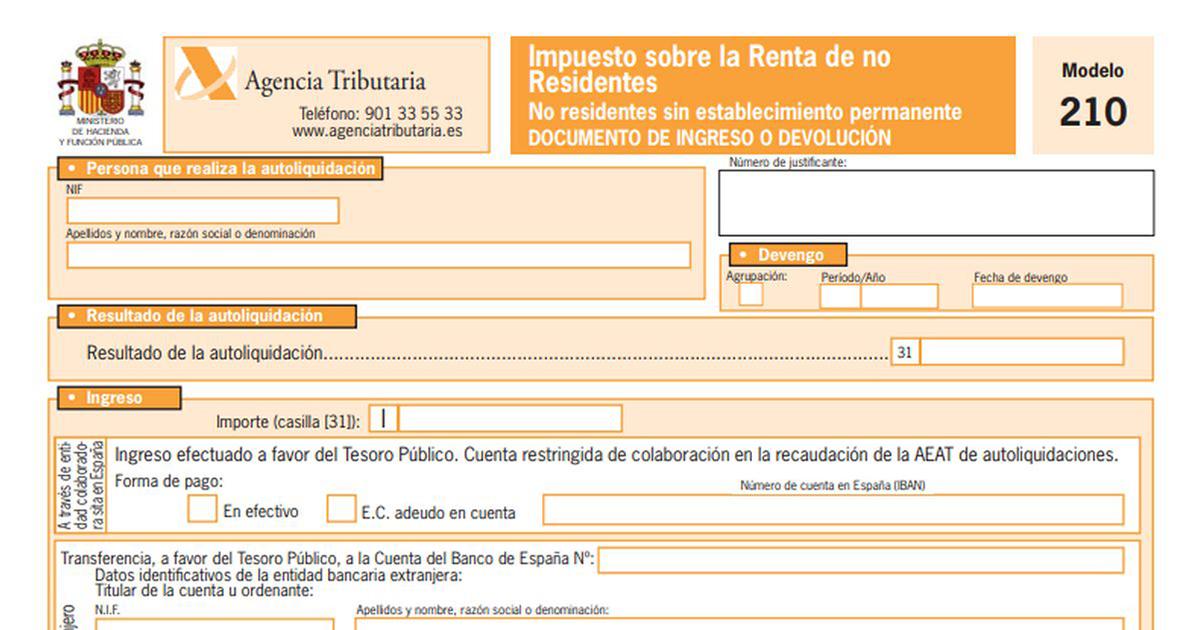

Modelo 210 form - what is it, when is it, and who fills it out?

Poles are increasingly eager to invest in the Spanish real estate market. Some have taken a liking to the country because of its warm climate, while others appreciate the stability of the market and the extensive offer of houses and apartments. It is worth remembering, however, that owning a property in Spain involves a Modelo 210 declaration - what is that?

What is the Modelo 210 form?

Modelo 210 is a tax return filed by non-residents who earn income in Spain. The form is used to account for IRNR tax - Impuesto sobre la Renta de no Residentes. The tax rate for citizens of the European Union and the European Economic Area is 19%, while citizens of other countries pay a tax rate of 24%.

How to make a Modelo 210 declaration?

The declaration can be filed electronically using an electronic signature accepted by the Spanish Tax Authority (Agencia Tributaria). Individuals can also file their returns via the Cl@ve system. In addition, it is possible to fill out the form online, print it out and then deliver it to the appropriate Tax Authority subdivision.

Who must account for IRNR tax?

The IRNR tax is settled by individuals who earn income in Spain but have tax residency in another country. Specifically, preparation of IRNR tax return - Modelo 210 applies to property owners in Spain. The form must be completed in the case of:

- possession of real estate for private purposes;

- deriving income from rental property;

- real estate sales.

IRNR tax accounting methods

For citizens of Poland and other EU/EEA countries, the IRNR tax rate is 19%. Citizens of third countries pay a tax rate of 24%. The tax base depends on the situation:

Property for personal use

In the case of real estate used for nonprofit purposes, an individual accounts for so-called imputed income. The tax base is 1.1% or 2% of the cadastral value of the property, which is stated on the property tax receipt (IBI). A tax of 19% or 24% is calculated on the base thus calculated.

Rental property

If the property is rented to individuals, then rental income is taxed. The tax base can be reduced by showing expenses directly related to the property (e.g., repairs, utilities). A 19% or 24% income tax is then calculated.

Real estate sales

Non-residents also fill out the Modelo 210 form after selling the property - this is a capital gains tax. The tax base is the difference between the purchase price and the sale price of the property, less costs and expenses related to the property. When accounting for the tax, an advance tax payment of 3% is taken into account, which must be collected and paid by the new property owner. If the advance payment is higher than the tax liability, then the seller may receive a refund of the excess.

By when should the Modelo 210 declaration be filed?

The deadlines for settling IRNR tax and filing Modelo 210 returns depend on the type of income:

- imputed income must be settled by December 31 of the following calendar year;

- income from the sale of real estate must be settled within four months from the date of sale (the buyer has one month to make the down payment);

- rental income from real estate can be settled once a year (on January 1-20) or quarterly (on the first 20 days of January, April, July and October).

How to avoid problems with the Spanish Tax Authority?

The Spanish Tax Authority may impose financial penalties for failing to file the required tax return or submitting false information. In addition, interest is charged for failure to meet the tax payment deadline. Given the lack of language skills and the rather complicated regulations, it is worthwhile to use the services of, for example, a Polish-language accounting firm espaytax, which specializes in tax returns for non-residents. By working with a professional accounting firm, you can avoid penalties and take advantage of tax optimization and available reliefs. Noteworthy, espaytax is a member of the national organization ASEFIGET (Asociación Española de Asesores Fiscales y Gestores Tributarios) and a registered Colaborador Social AEAT. This ensures a professional service and authorizes espaytax to handle tax matters online on behalf of clients before the Spanish tax authority.

For more information on filing the Modelo 210 declaration, please contact:

- at: https://www.espaytax.com/podatki-w-hiszpanii

- by phone: +34 603 685 558 (Spanish number) or +48 603 307 939 (Polish number)

- via email: kontakt@espaytax.com