Short-term and car rental obligations in Spain: new regulations for guest registration and platform changes

News/

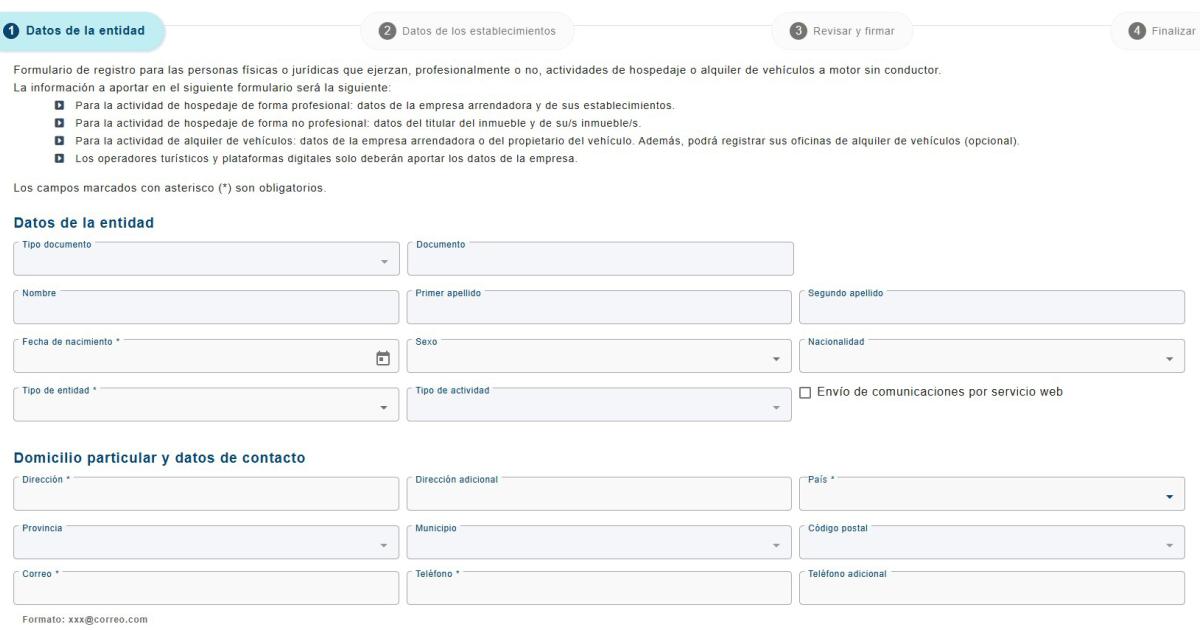

Spain's Interior Ministry has introduced a new platform, SES.Hospedajes, which replaces previous systems such as the Civil Guard's Hospederías application and the National Police's WebPol/e-Hotel. All facilities renting for tourism purposes must register their guests on this platform. The change is mandatory as of October 1, 2024, but the transition period has been extended until December 2, 2024. After that date, non-compliance can result in fines, ranging from €100 to €30,000, depending on the severity of the violation.

Key requirements:

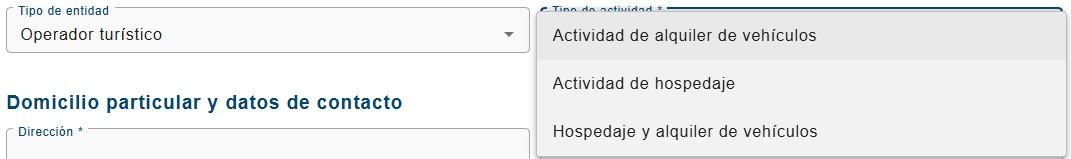

Registration with SES.Hospedajes:

• The property must be registered on the platform using the owner's digital certificate or Cl@ve account.

• Upon registration, the user is given an ID number, landlord code and system access data.

Link to website: https://provider.ses.mir.es/SP2/IndexPage?redirectUrl=https://hospedajes.ses.mir.es/hospedajes-sede/%23/registro/&returnUrl=https://provider.ses.mir.es/SP2/ReturnPage&providerName=S2816021F_E00003801&spApplication=Sede+electronica+&nodeServiceUrl=https://pasarela.clave.gob.es/Proxy2/ServiceProvider&eidasloa=http://eidas.europa.eu/LoA/low&afirmaCheck=false&gissCheck=false&aeatCheck=false&eidasCheck=true

Guest Reporting Obligation

Data of all guests (including children, though with different specific requirements) must be reported to the relevant service. For adults, a full set of data and a signature (digital or physical) is required.

Automate the process

There are tools such as Roomdoo or Check-in Scan that integrate with SES.Hospedajes and automate the registration process, saving time and reducing the risk of errors.

Penalties for non-compliance

Penalties for non-registration or reporting errors can range from 100 up to €600 for minor violations, and up to €30,000 for serious violations.

Other obligations

• Facilities must maintain registration books, keep them for a minimum of three years, and make the data available upon request from the department.

• It is also required to report the landlord's activities to the tax authority and comply with local tourism regulations, including payment of tourism taxes, if applicable in the region.

More details about the registration process and the platform SES.Hospedajes you will find https://sede.mir.gob.es/opencms/export/sites/default/es/procedimientos-y-servicios/hospedajes-y-alquiler-de-vehiculos/